Oracle shares fall more than 12% on light cloud revenue

In this article

- ORCL

Oracle shares fell more than 12% Tuesday after the company missed estimates on revenue in its fiscal second-quarter earnings report posted Monday evening.

The software company posted adjusted earnings per share of $1.34, narrowly beating the LSEG (formerly Refinitiv) estimate of $1.32. Its revenue came in at $12.94 billion, missing the $13.05 billion projection.

Wall Street analysts pointed to Oracle's cloud revenue shortfall in notes to investors.

"For the second straight quarter, Oracle didn't meet Cloud/OCI growth expectations and again pinned the blame on the pace of infrastructure capacity build-outs, which is disappointing and tough to get visibility into (what could be taking so long?)," wrote UBS analysts in a Tuesday note to investors.

JPMorgan analysts expressed concern about the company's ability to beef up its Oracle Cloud Infrastructure at a fast enough rate.

"While there seems to be ample OCI demand for now, there are questions around Oracle's ability to build out modern datacenter capacity quickly enough," the JPMorgan analysts wrote.

The capacity limitation would stop Oracle from taking advantage of the "unlimited demand" for its infrastructure that the company has spoken about, according to JPMorgan.

Analysts at Deutsche Bank said they can understand the stock slide, however they remain bullish and kept their buy rating on Oracle, citing two roughly $1 billion deals co-founder Larry Ellison announced, solid demand and "a commitment to maintaining 50%+ OCI growth for 'a few years' at an increasing scale."

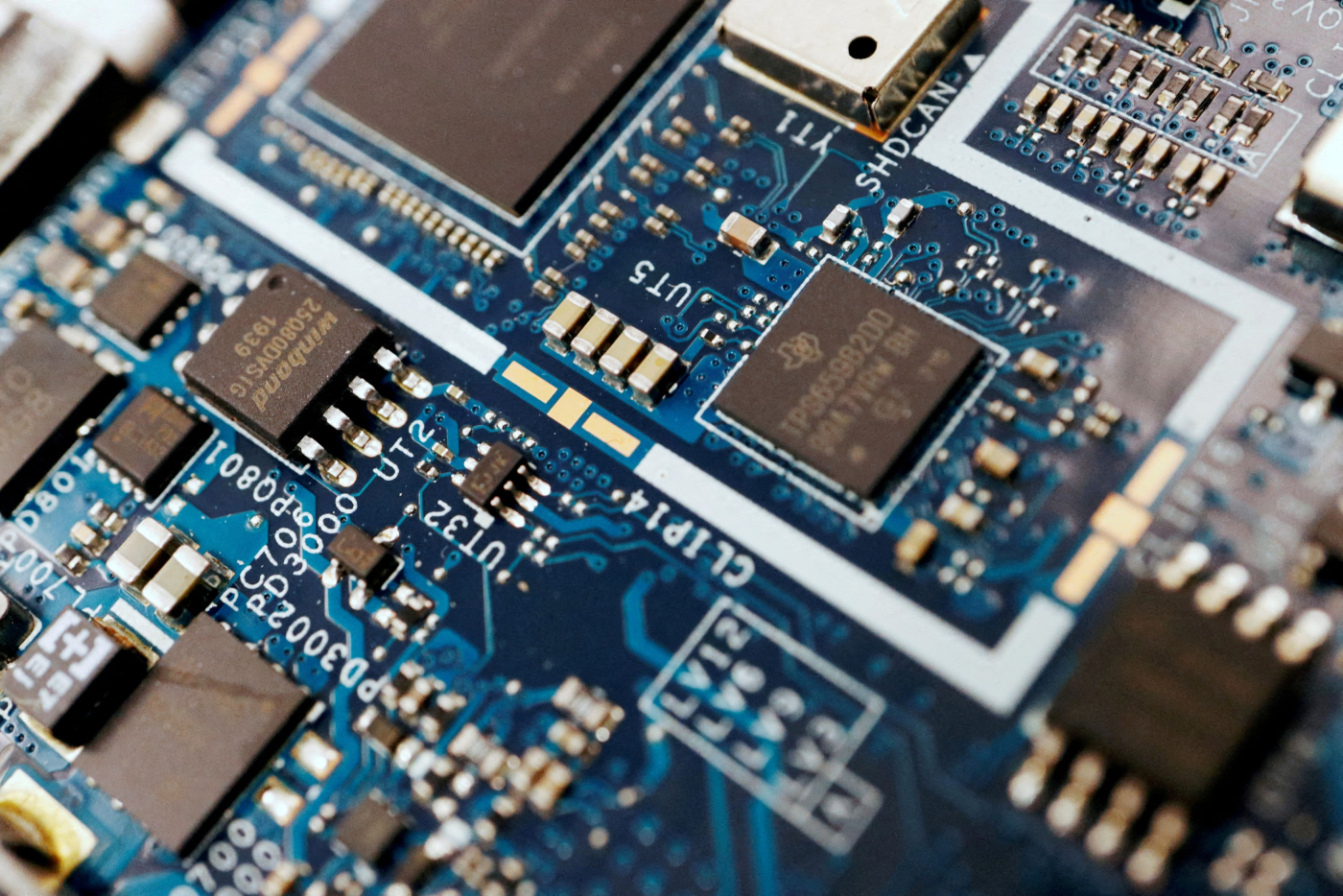

Oracle is also massive purchaser of chips, both the high-powered graphics processing units that Nvidia makes and the central processor units from AMD and Ampere. Nvidia's GPUs are the chips powering much of the artificial intelligence boom.

The company has partnerships with other tech giants, including Microsoft, which gives customers access to Microsoft's cloud service Azure.

— Our's Jordan Novet and Michael Bloom contributed to this report.

Don't miss these stories from Our PRO:

- Five stocks to buy before the year end, according to the pros

- Morgan Stanley fund manager names 4 top stocks to buy 'on the cheap'

- JPMorgan picks China stocks to buy now. Alibaba's not on the list

- Analysts love this self-driving car tech stock and give it over 400% upside

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.