Oracle bumps up fiscal 2026 revenue forecast, lifting stock 6%

In this article

- ORCL

Oracle shares rose about 6% in extended trading on Thursday after the database software maker raised its fiscal 2026 revenue guidance and issued a heady forecast for the 2029 fiscal year.

At an analyst meeting coinciding with the Oracle CloudWorld conference in Las Vegas, the company said it now sees at least $66 billion in fiscal 2026 revenue. Analysts surveyed by LSEG were anticipating $64.5 billion.

Oracle's good week is continuing. Shares gained around 15% the past three trading sessions and are trading at a record after the company announced quarterly results that topped expectations. The stock is now up 55% for the year, behind only Nvidia among large-cap tech companies.

Oracle sometimes also gives guidance multiple years out. The company said on Thursday that, looking out to the 2029 fiscal year, it sees over $104 billion in revenue, along with year-over-year growth in earnings per share of 20%.

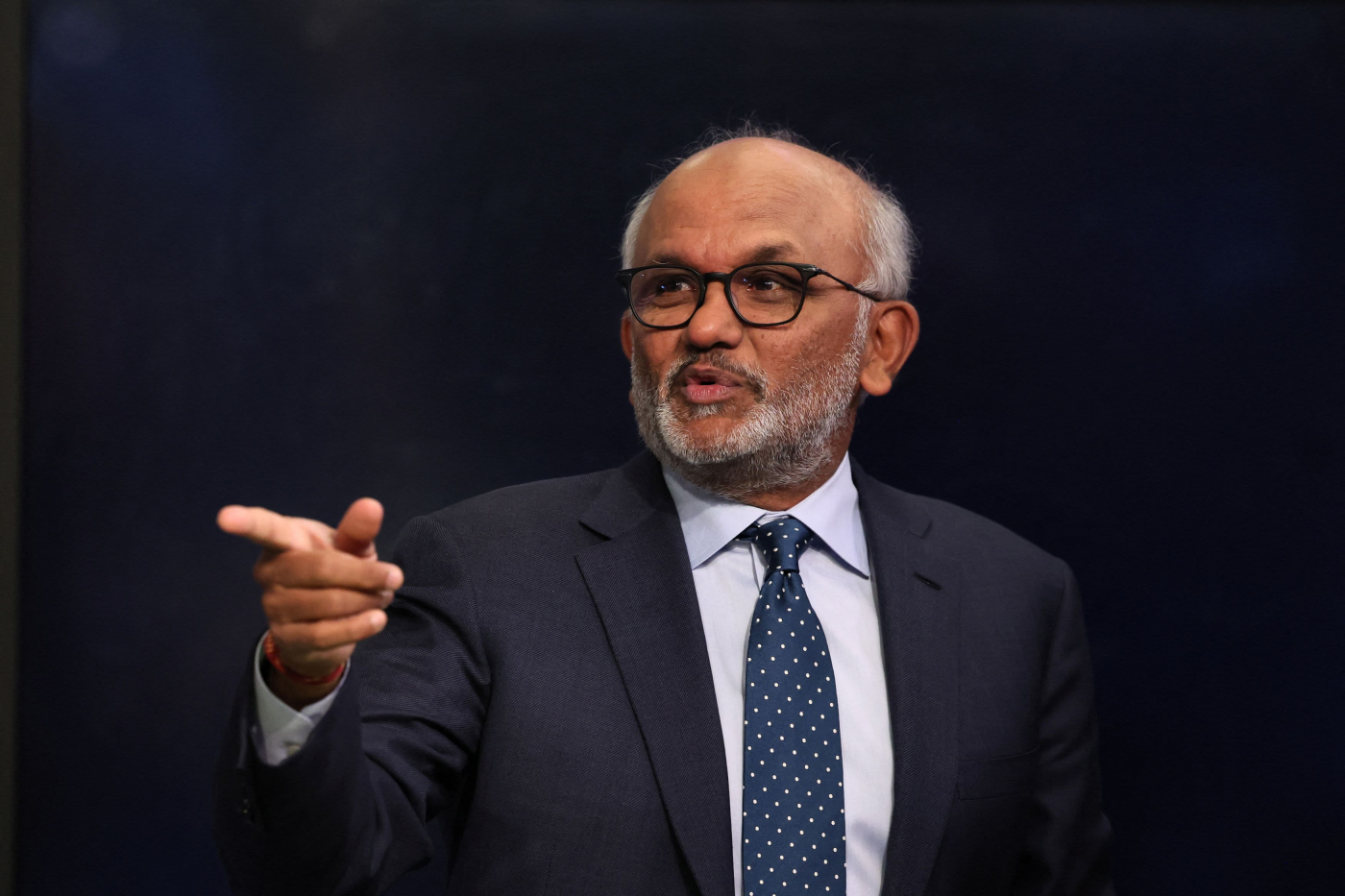

"Those numbers should not be a problem. At all," CEO Safra Catz said at the event. She pointed to partnerships that will allow companies to use Oracle database software through top-tier cloud providers Amazon, Google and Microsoft. Oracle announced the Amazon relationship on Monday.

The company's cloud infrastructure revenue grew 45% in the most recent quarter, a quicker pace than at Amazon, Google or Microsoft.

In addition to generating more revenue as companies move workloads to the cloud from their data centers, Oracle has a shot at growing in artificial intelligence. On Wednesday, Oracle said its cloud unit that competes has begun taking orders for a cluster of over 131,000 next-generation "Blackwell" graphics processing units from Nvidia.

As Oracle plans to expand revenue, Catz said she expects capital expenditures to double in the current 2025 fiscal year.

WATCH: Investors starting to look 'longer term' on Oracle, says Wolfe's Alex Zukin

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.